The Importance of Financial Education in Schools

As children we all have played or heard of monopoly, the colorful bills, endless properties. Play money was all we had back then. Several years later when you get your first job we can’t really rely on our monopoly skills to help us stay afloat since there isn’t a parking spot that will ensure nothing will happen to us. It is important that now we take advantage of our malleable brains before it is too late and implement financial literacy classes in all high schools.

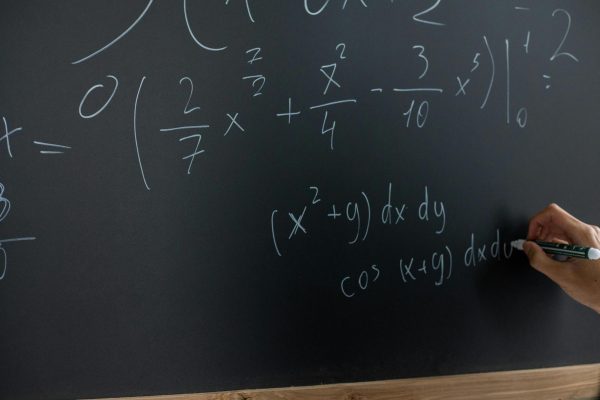

203 million Americans are living paycheck to paycheck and this is 55% higher than reports from 2021. This happens when people prioritize immediate spending money rather than saving up. Having financial education in school helps students develop good money management skills and it teaches them how to use their money to benefit them. Students will learn how to spend wisely and For example, in my PFLSS (personal, financial, literacy, study, skills) class in school I learned how to allocate money into stock markets. Financial literacy isn’t just about money and teaches kids how to problem solve. By learning how to manage their finances children will be better equipped to live independently in the future.

As of 2021 our country faces 1.59 trillion dollars in student loan debt. They might choose to pursue different opportunities in the future that may benefit them. Not only are people more likely to be college debt free but two-thirds of high school students said they were now bringing in an average of $3000 monthly income per year.

Currently 15 states require students to take a financial literacy class to graduate. As our economy continues to grow we owe to the future generations to prepare them for financial decisions they will have to make as an adult. Making financial literacy a graduation requirement will benefit high schoolers.